The post NJ Sales Tax Manufacturing Exemption. Multistate Tax Commission the Streamlined Sales and Use Tax Agreement Certicate of Exemption the same information in another format from the purchaser or resale or exemption certicates or other written evidence of exemption authorized by another state or country.

Income Tax Return Filing Tax Slabs Exemption Limits Other Rules Income Tax Return Income Tax Tax Return

This will appear on Column N Nelson Market Economic Development District of the parish sales tax return.

. MAY NOT BE USED TO PURCHASE CIGARETTES FOR RESALE. In the year since the decision more than 40 states have enacted remote sales tax laws that base a sales tax collection obligation solely on economic activity economic nexus. SALES AND USE TAX CERTIFICATE OF EXEMPTION.

Sales by religious organizations and sales of food by volunteer fire companies and veterans organizations are exempt. Check Type of Certificate c Single Purchase If single purchase is checked enter the related invoice or purchase order number _____. And now that states can tax out-of-state sales your business may have new sales tax collection obligations.

Alabama sales tax exemption and resale certificates. Private individuals are not eligible for a sales and use tax exemption certificate. For Sales Tax Exemption 13 Nebraska Resale or Exempt Sale Certificate FORM Name and Mailing Address of Seller.

Specific tax rules can be set within the system to allow for specific product tax rules. If you order and pay for an eligible item over the internet on the sales tax holiday Eastern Daylight Time that item will qualify for the sales tax holiday. Also effective October 1 2022 the following cities.

In order to access this information taxpayers should create a user name and password by clicking SIGN. Effective January 1 2018 the New Jersey Sales and Use Tax rate decreases from 6875 to 6625. Affidavit in Support of a Claim for Exemption from Sales or Use Tax for a Motor Vehicle Trailer or Other Vehicle Transferred to an Insurer PDF 8599 KB Revised November 2018 Open PDF file 5229 KB for Form MVU-24.

If your company sells taxable. The Nebraska state sales and use tax rate is 55 055. If everyone has to pay the admission in order to gain entry into the venue regardless of whether they participate in the tastings or not.

INSTAVAT Info Private Ltd Maharashtra Andhra Pradesh State India professional consultants having experience in the field of Sales Tax of more than 25 yearsSales tax is charged at the point of purchase for certain goods and services in Maharashtra State IndiaService tax charged on service providers in Maharashtra State India. After January 1 2018. DR 1369 - Colorado State Sales Use Tax Exemption for Low-Emitting Heavy Vehicles Affidavit.

The tax rate was reduced from 7 to 6875 in 2017. Form SC-6 Salem County Energy Exemption Certificate. And local delinquency rate for any location in Louisiana by Geocode.

353-Effective July 1 2018 See instructions - Item 75 National Volunteer Womens. If you purchase or lease the vehicle from a licensed business the seller must keep records and provide information to DOR to support the exemption. Do those sales qualify for the sales tax holiday exemption.

Sales Tax Rate Change. C Blanket If blanket is checked. The New Jersey sales and use tax exemption for manufacturers enables machinery apparatuses or equipment to be purchased without paying New Jersey sales and use tax.

In addition to the privilege tax an additional 50 transient tax is due on income from charges for lodging to any transient. VAT tax collected at every transaction for a. Open PDF file 8599 KB for Form MVU-23.

Retail Sales Tax CR 0100AP- Business Application for Sales Tax Account DR 0100 - 2022 Retail Sales Tax Return. Additional information about the Sales and Use Tax rate change is available. Organization pursuant to Section 1356 or 1357 of Title 68 in order to make a purchase exempt from sales tax for hisher.

The appropriate tax rate is then determined and applied to the order. Used qualifying vehicles will receive a 100 sales or use tax exemption up to 16000 of the sales price or the fair market value at the inception of the lease. New Jersey Revenue Statute 5432B-813a further clarifies the sales and use tax exemption by stating that the machinery apparatuses.

3-2018 Supersedes 6-134-1970 Rev. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. Place a check in the box that describes how you will use this certicate.

For use by a Virginia dealer who purchases tangible personal property for resale or for lease or rental or who purchases materials or containers to package tangible personal property for sale. This Certificate of Exemption. Example 6 Customer purchases an item from Dealer for a sales price of 10000 on July 1 2017 and pays 530 in sales tax for a total of 10530.

Fifty percent 50 of the transient tax revenues are used for destination marketing to promote tourism and fifty percent 50 are used for tourism-related event support tourism research tourism-related capital projects and other eligible uses as determined by City. T here is a 1 sales tax increase to take effect July 1 2021. In June of 2018.

Service Organization See item 31. Dealer remits 525 in sales tax to Virginia Tax and keeps 005 as his dealer discount. When recovering the amount of sales tax previously reported and remitted to Virginia Tax.

Legislation was signed into law in 2018 that established an annual sales tax holiday for one weekend each year. In June 2018 the Supreme Court of the United States overruled the physical presence rule with its decision in South Dakota v.

How To Get A Sales Tax Certificate Of Exemption In Virginia Startingyourbusiness Com

Today File Rate 22 05 2018 Estate 4u Real Estate Consultants Syed Khurram Gillani 92 321 987 8600 92 42 35709950 Bahawalpur Estates Rate

Sales And Use Tax Exemption Letter How To Write A Sales And Use Tax Exemption Download This Sales Letter With Use Of Ta Tax Exemption Lettering Sales Letter

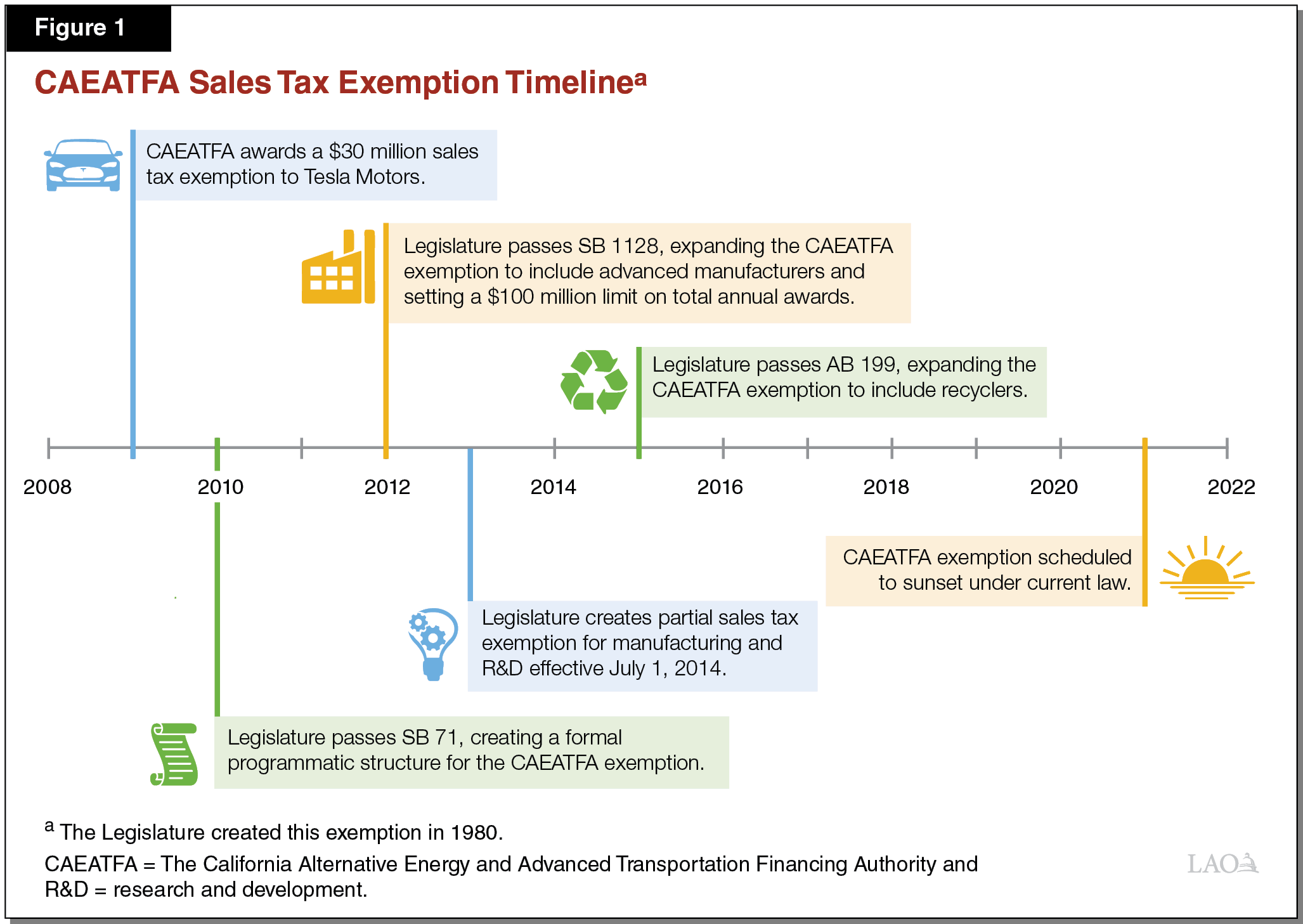

Evaluation Of A Sales Tax Exemption For Certain Manufacturers

Requirements For Tax Exemption Tax Exempt Organizations

Income Slab Tax Rates For Ay 2018 19 Fy 2017 18 Income Tax Return Income Tax Tax Exemption

Sales Tax And Tax Exemption Newegg Knowledge Base

Historic Tax Refunds Will Extend Retail Boom Into 2019 Best Cyber Monday Deals Black Friday Sale Tax Refund

Five Key Things To Know About The Foxconn Contract Wisconsin Budget Project Things To Know Wisconsin Budgeting

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

Harpta Maui Real Estate Real Estate Marketing Maui

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Money Isn T Everything Capital Gain

Missouri 149 Sales And Use Tax Exemption Certificate

Calculation Of Ltcg Tax On Sale Of Shares Equity Mutual Fund Units 10 Ltcg Tax On Sale Of Stocks Equity Mutual Funds Budge Budgeting Mutuals Funds Equity

Beware Of Designation Of Homestead Offers Texas Ag Warns